Sticker shock is real—and in the home services industry, it can kill a deal on the spot. When a homeowner hears the price for a roof replacement, basement remodel, or full HVAC system, they often pause... then disappear. The solution isn’t to lower your price. It’s to make the investment easier to say yes to.

That’s why financing can help contractors close more deals, and in 2025, it’s one of the smartest tools you can offer your customers.

The Cost Barrier Is Real

Even when homeowners love your work and trust your team, cost can still be the dealbreaker. A $15,000 remodel or $20,000 roof isn’t an impulse buy. Without flexible payment options, you force your customer to walk away—or delay until “sometime next year.”

Financing changes that conversation. It shifts the focus from the total project price to a manageable monthly payment—and that keeps the deal alive.

Give Homeowners a Path to Yes

When you offer financing directly through your site or sales process, you give homeowners the confidence to move forward sooner. They stop worrying about cash flow and start thinking about results.

That’s why PSAI integrates payment messaging directly into tools like the Roofing Calculator. When a lead receives an instant estimate, they also see what it looks like as a low monthly payment. This removes resistance and keeps them engaged.

Stand Out From the Competition

Most contractors still treat financing as an afterthought. They bring it up only when the customer hesitates—or worse, after the proposal has already stalled. But when you advertise flexible payment options up front, you position yourself as the company that makes big projects more accessible.

Adding financing language to your Lead Capture Forms or your website header instantly improves engagement and sets you apart from competitors who rely on traditional, cash-only closing.

Shorten the Sales Cycle

When homeowners know financing is available, they spend less time price-shopping and more time asking the right questions. It moves the conversation from “Can I afford this?” to “How soon can you start?”

Financing removes emotional hesitation and lets your team close faster. You reduce ghosting, eliminate follow-up fatigue, and create a clear next step that feels realistic for the homeowner.

Financing can help contractors close more deals—and also close them faster.

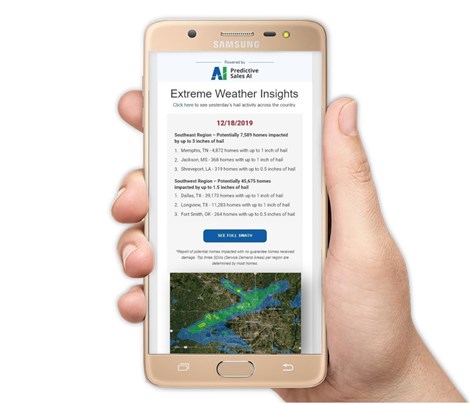

Automate the Financing Message

The key to success isn’t just offering financing—it’s making it visible and automatic. PSAI makes it easy to embed financing messaging across your entire funnel. Whether it's in a chatbot conversation, an AI-powered estimate, or a lead capture form, the message stays consistent.

This automation ensures every lead sees financing options without your team needing to manually mention it every time.

Increase Close Rates Without Lowering Prices

Contractors often discount to save the sale. But that’s not necessary when financing is in place. You can maintain your full margins and still give the homeowner an affordable path forward.

It’s the win-win scenario: your profits stay intact, and the customer gets the project they want, when they want it.

Financing Is a Sales Tool—Not Just a Feature

If you’re serious about growth, start using financing as a strategic advantage, not just a checkbox on a proposal. With Predictive Sales AI, you can present monthly payments from the first interaction—making it easier for homeowners to commit and for your team to close.

Want to see how financing can help contractors close more deals across roofing, remodeling, and service work? Contact us and let PSAI help you turn quotes into jobs faster.